The Background

Do you care about driving demand for regeneratively produced products? Then this blog is for you!

NielsenIQ is one of the leading providers of data & insights to the CPG industry. Sherry Frey, VP of Total Wellness, was kind enough to share a deck with some data that was previously shared at Expo West in March 2023. The deck includes information on the desires of the modern consumer, the growth of regenerative product claims, and much more.

I dove into the data in a video you can watch HERE.

All the insights and commentary are also included below with images of the individual slides.

1. Health + Wellness Benefits Must Lead

Altruism doesn’t sell product. So while it is great that regenerative agriculture can sequester carbon, clean waterways, increase farmer livelihoods, and improve biodiversity…the average consumer just doesn’t care. They are way more focused on health + wellness outcomes that products deliver to themselves and their families. It still is (and always will be) a self-interested market.

While regenerative sourcing is an amazing story to tell, it is the wrong one to “lead” with in terms of driving sales, especially at the point of purchase (grocery stores). Every regenerative brand and regenerative product needs to get crystal clear on the main health + wellness outcome they are delivering to the customer through their product(s), and then they need to lead with that in marketing efforts. Does it make me skinnier, does it make me have more energy, does it reduce my stress?

Health and wellness benefits have to be the leading value proposition for regenerative brands.

(I'm tired of not having scaled and affordable nutrient density testing, Grandpa!)

2. “Altruistic” Benefits Can Drive Price Premiums

Relatedly, consumers are waking up to the adverse effects that environmental issues are having on their health (61% in the above slide), and NIQ is showing data that some people will pay higher prices for some of these more altruistic community benefits (64% in the above slide).

So while altruistic benefits should not be a leading value prop to drive purchase, there is data to show it can drive price premiums. This sort of margin expansion is key for regenerative brands that are internalizing costs the commodity food system gets to externalize. Regenerative aside, CPG brands at all stages must have healthy margins to survive.

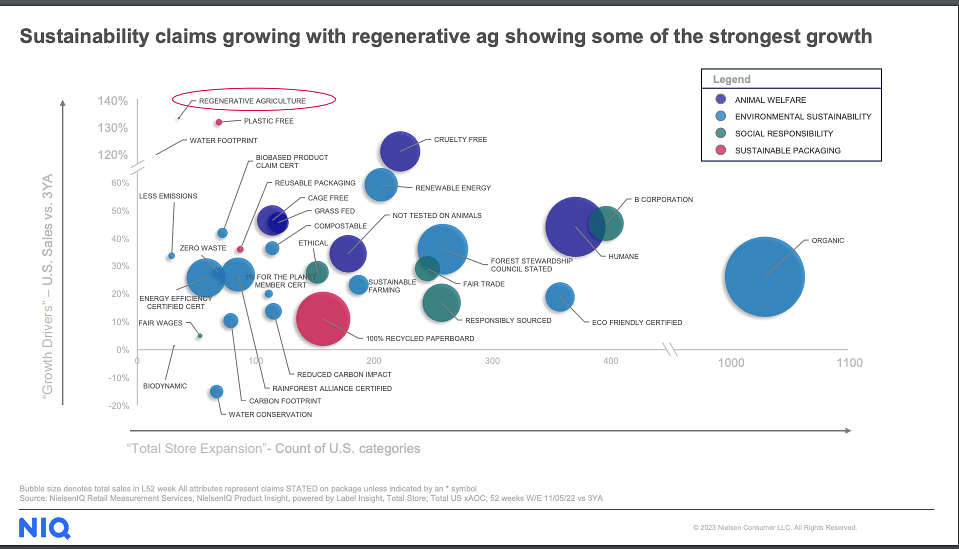

3. Regenerative Agriculture Is The Fastest Growing Claim In CPG

Let me explain the image above:

- Text like “organic,” “humane,” “regenerative agriculture,” etc. are all various claims being attached to CPG products.

- Horizontal axis: showing the number of times the claims are being made in the market (how many products are claimed “organic,” “humane,” “regenerative agriculture,” etc. - organic far and away the leader)

- Vertical axis: showing the growth in new claims being made by type (how many products are showing up with NEW claims for “organic,” “humane,” “regenerative agriculture,” etc. - regenerative agriculture claims are growing FASTER than any other one listed on this graph)

- Circles by claims: The current sales numbers associated with that claim (the current market for that claim based on sales data - “organic” is huge and “regenerative agriculture” is tiny

4. Sales From Regenerative Products Are Still Small

Main takeaways: Regenerative agriculture claims are growing extremely fast, but the current market for those products is still very small. A huge opportunity for growth but a challenge in terms of visibility, availability, and consumer awareness.

Time, education, and successful brand + retailer execution are needed to get that circle bigger.

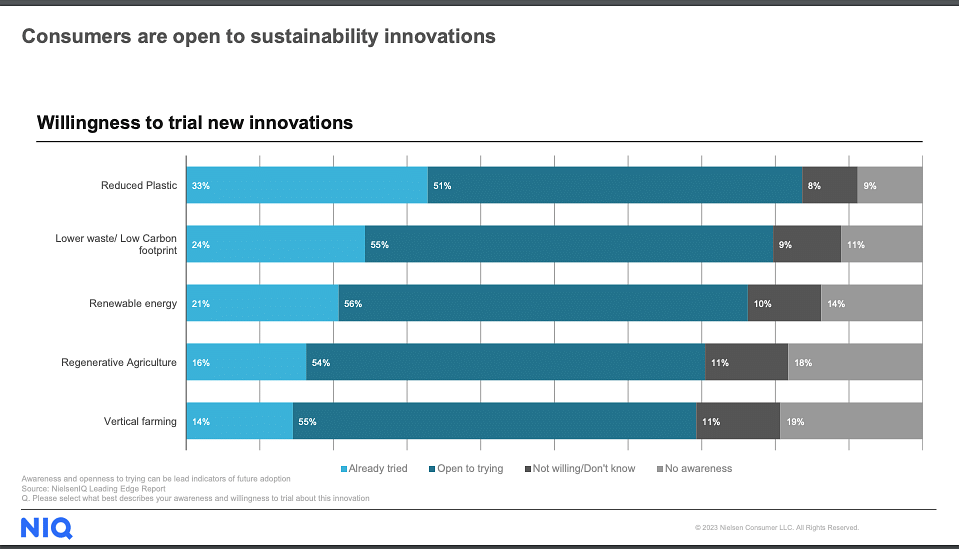

5. There Is Opportunity With At Least 88% of Consumers

What does a recipe for opportunity look like?

When 16% of consumers have already tried something in the category, 54% are willing to try something, and 18% haven’t even heard of it.

There is a HUMONGOUS white space for brands to “strike while the iron is hot” and drive trial of regenerative products with consumers while the phrase is relatively nascent but growing rapidly.

⬇️ Me at the store when I see my favorite regenerative brands seizing this opportunity 😂

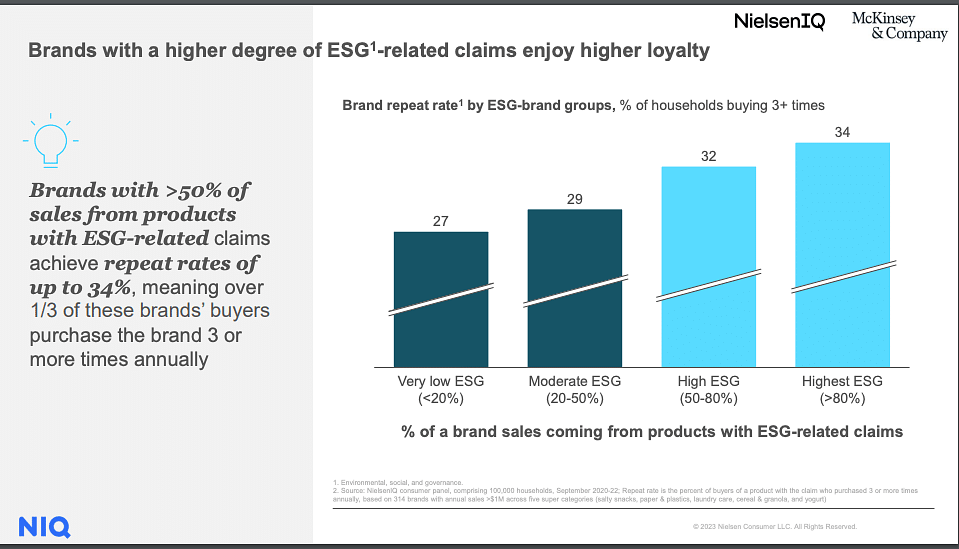

6. Regenerative Can Drive Higher Repurchase

“Environmental, social, and governance (ESG) investing is used to screen investments based on corporate policies and to encourage companies to act responsibly” (Investopedia) Regardless of ESG currently being weaponized by politicians, it should represent a transition to a future investing paradigm that takes into account factors beyond just financial success. Regenerative brands should, in theory, be extremely well situated to score high ESG scores and take advantage of all the “responsible” work they're doing. This is more theory than reality right now, especially for early-stage brands with limited exposure to institutional investors.

I don’t care, AC!! Just tell me what it means for brands right now!!!

Right…

My take on this is that it means regenerative makes your product “stickier.” While it cannot be the leading driver of purchase (is there an echo in here?), it can be an amazing retention tool once customers have tried your product(s).

So I think the story of regenerative agriculture, if executed correctly by brands, can drive premium prices (there’s for sure an echo in here...) AND drive higher retention rates with customers.

The S in ‘ESG’ actually stands for “sticky” I think…

7. Younger Consumers Care More About The Environment But Have Less Money To Spend

BREAKING NEWS: Younger people care more about the environment!

More interesting news: This information doesn’t really matter (yet).

Why? Because the older demographics still have the money and drive the majority of purchases. This will matter more with time as Millenials, Gen Z, & Gen Alpha (oh yeah, there’s another one you old fart) advance in their careers, have more income, and spend more on food for themselves and their families.

The Recap

Regenerative brands should figure out the specific health + wellness outcome(s) of their product(s) and make that their leading value proposition to consumers. They should use the altruistic benefits of sourcing regeneratively to drive price premiums and customer retention after initial product trial. If they haven't already, brands should start making regenerative agriculture claims about their products as the market remains nascent and poised for growth (even though the number of claims is increasing rapidly). Lastly, regenerative brands have to play the long game to reap the benefits of ESG upside and the higher-income conscious consumers of the future.

Hi, I'm Anthony Corsaro 👋. I'm an entrepreneur, investor, and regenerative agriculture evangelist.

📧 Drop me a line with your thoughts on this blog!

This blog was produced completely by one human being and zero AI bots (big fan though and will use in the future 😂)