"Grass-Fed Beef Is The Waste Product of Carbon Sequestration"

Regenerative rancher Brian Alexander has been using a line on the Ranching Reboot Podcast that has been stuck in my head for weeks: “grass-fed beef will be the waste product of the carbon sequestration industry.” This will sound quite controversial, especially considering how maligned soil carbon markets have been (see here for the latest salvo, a nuanced take on the limits of soil carbon modeling).

However, the best investors I know have a sixth sense rarely discussed: recognizing the bottom.

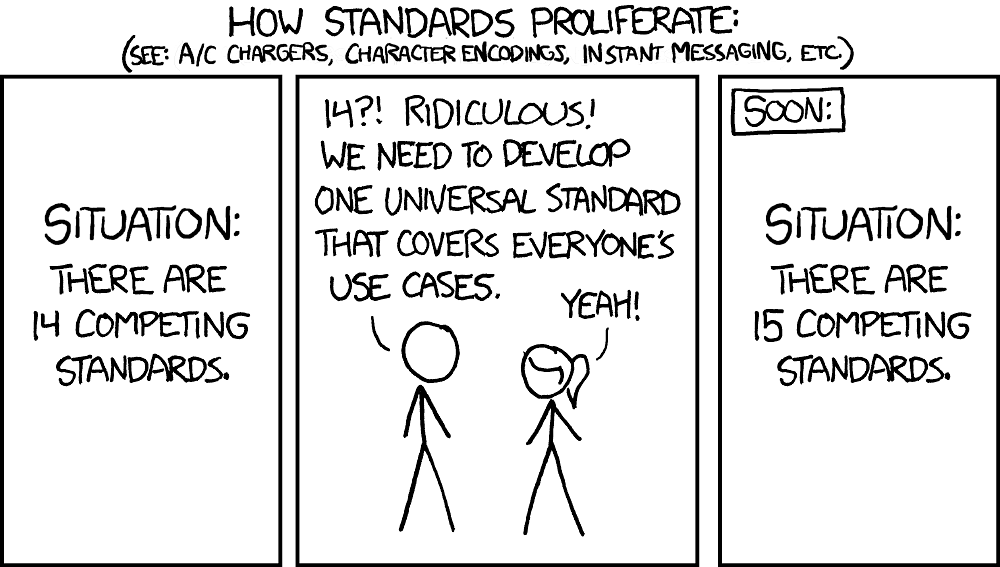

They know when an idea, trend, or cycle is at its lowest point and undervalued, typically after promises and inflated expectations have popped. This is where I posit we stand with agricultural carbon markets, especially those independently brokered into offset markets. Both agri-corporate scope 3 programs and offsets have an important role to play to serve the needs of different rancher segments. And if these markets succeed, then that increases the profitability and likelihood of success of various emerging grass-fed ranchers across America.

Carbon Markets (The Background)

Carbon markets have been around since the late 1990s, growing in yearly transaction values from less than $100M in 2005 to over $2B in 2021. In agriculture, the typical transaction structure has been around a project developer working with various “independent” farmers and ranchers to implement some improved land management practice and then generating credits that are sold for subsequent climate claims. Carbon programs in American agriculture were few and far between, scaling only in the late 2010s with the emergence of companies like Nori, Indigo, and the Ecosystem Services Marketplace Consortium.

Recently, the utility of offsets has been questioned: the Science Based Targets Initiative (SBTi) has eschewed offsets for the purposes of setting climate targets. Companies have pulled back on carbon neutrality claims in the face of new guidance and various lawsuits from activist groups. At the same time, food and ag companies have set internal goals for decarbonizing their supply chains. Buoyed by the large pools of government funding in the Inflation Reduction Act and Climate-Smart Commodities Program, the USDA expects up to 20 million acres to be converted to “climate-smart” ag practices (notably for this audience, this is not necessarily equivalent to regenerative agriculture). The promise is that tying the ecosystem service outcomes to the commodities will result in less greenwashing and force corporations to deal with their supply chain emissions directly.

The Context for Beef

Exactly how companies will go about this depends on a variety of factors. In many cases, corporations cannot tie the commodities they’ve bought to exact fields, so they employ “supply shed” approaches in which they enroll farmers in a broader geographic area and support practice changes. In animal agriculture, which faces similar issues of limited traceability, much of the discussion has been on feedlot interventions (think feed additives, lower carbon intensity of animal feed, and digesters) since there is more traceability between the corporates buying the beef and the finishing stage.

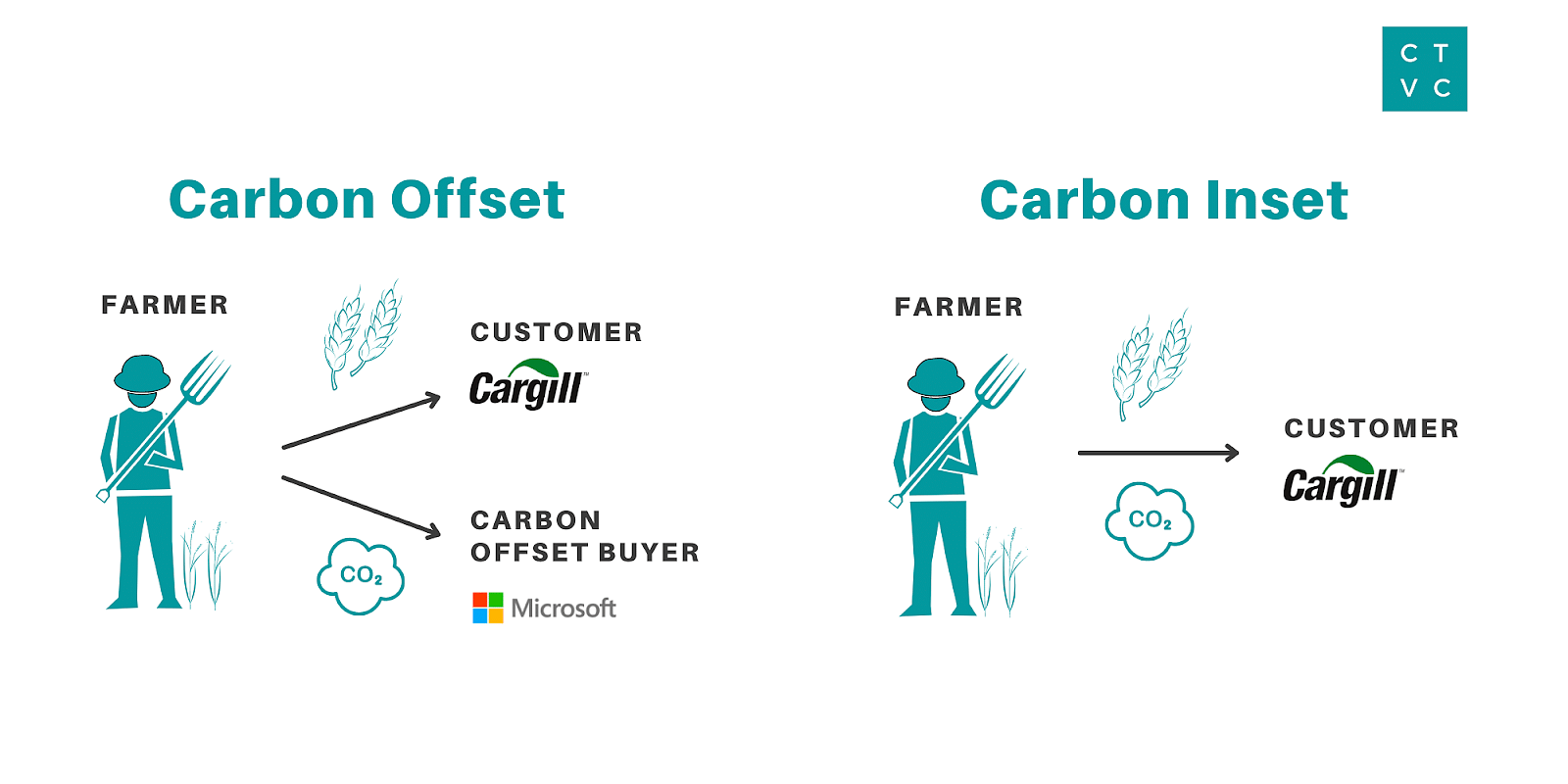

What’s lost in this eternal debate is how we will need both offsets and insets to have a systems-level change toward more grass-fed beef.

A focus on Scope 3 emissions reductions could help food companies finance new grass-fed product lines, but their focus lies elsewhere today. Right now, they're mainly focused on “trimming the carbon fat” in existing operations and implementing high-level improved pasture management at the cow-calf stage through large, supply-shed approaches. And if you think there are too many standards in offset markets, just wait until you have to wade between the bespoke certifications created for various Climate-Smart Commodities programs for lower carbon beef, new insetting “platforms,” and industry trade group labels.

Why Ranchers Need Offsets

While insetting is having its moment in the spotlight, consumers and investors who care about building up grass-fed beef in the US should consider how offset markets can support ranchers. Here are a few examples:

1) Many of the ranchers I talk to see carbon as a way to double or triple their profit (not revenue) over time. Programs and enabling marketplaces are emerging that let ranchers broker their carbon outcomes every year into either offset or inset programs. Approaches like these keep both markets honest, as offsets become a price floor for producers. The trade-off is that producers will need to sign longer-term contracts, but it guarantees optionality into multiple carbon markets and that ranchers are getting the best price possible.

2) For ranchers who directly market their beef to consumers, enrolling in offset programs results in more operational and financial freedom. Offsets provide a hedge in down years and an incentive to keep a stable herd size to optimize for carbon sequestration. Hypothetically, these ranchers would not be able to enroll in insetting programs (though they might qualify).

3) Many ranches make the majority of their income off non-cattle operations, like hunting, recreation, and mineral leases. Offsets align well with these folks whose priority is not always cattle yet value land stewardship, especially when it comes to credit types focused on grasslands conservation.

Looking Ahead

This is still an opportunity to revisit our economy with first principles thinking instead of perpetuating the commodity fetishism of carbon intensity.

While I can say with humility that I do not know what ecosystem service markets will necessarily look like in 5, 10, or 50 years, I do know that these markets will be present and essential to supporting the farms powering the regenerative CPG brands we all hope to see more of in the future. Whether this happens with the rancher working with a large beef brand on a new grass-fed product line or the direct marketer selling a variety of products locally, it’s time to unleash the conservation economy and make nature restoration profitable.

Hi, I’m Kevin Silverman 👋. My north star is keeping the regenerative agriculture movement focused on rural communities and producer equity. I have worked in carbon markets for the last three years in a variety of roles.

Editor's Note: The views expressed in this article are the author's alone and do not necessarily represent those of the ReGen Brands platform or team.